Depreciation of Manufacturing Equipment

Wooden parts utilized in artificial silk manufacturing machinery. Insurance and taxes related to the factory.

Depreciation Formula Examples With Excel Template

Air pollution control equipment being Electrostatic precipitation systems Felt-filter systems Dust collector systems Scrubber-counter current venturi packedbed cyclonic.

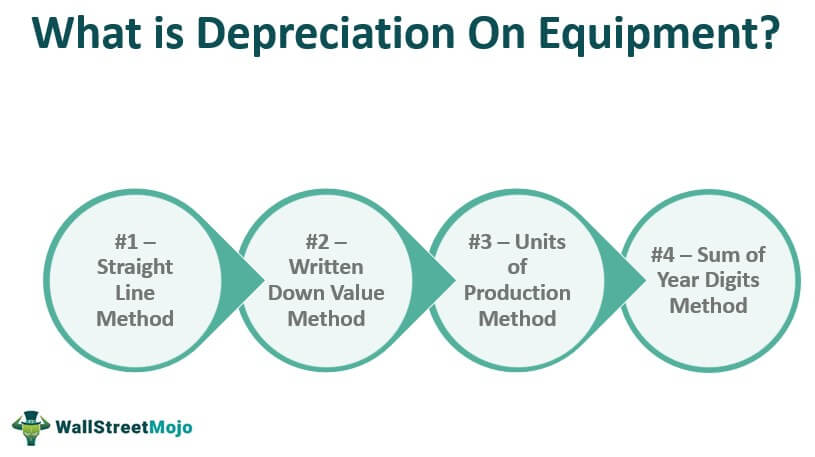

. It depends on the asset class. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value. Double-declining balance depreciation method.

Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below. Grain mill product manufacturing. Soft drink cordial and syrup manufacturing.

The formula for this type of depreciation is as follows. Depreciation on the manufacturing equipment and facilities. Year 5 works a little differently.

Note that idle facilities and land held for. Usually manufacturing overhead costs include depreciation of equipment salary and wages paid to factory personnel and electricity used to operate the equipment. - Management accounting by Eldon Wiley 1979 -.

SLM depreciation 10000000 100000025. Each year the company is matching 50000 of the equipments cost to that years revenues that are earned because of the equipment. Tax depreciation refers to the amounts reported on the companys income tax returns and in the US.

Note that all of the items in the list above pertain to the manufacturing function of the business. Insurance and equipment depreciation we would have the following. Other laboratory equipment including centrifuges drying oven s fume cupboards etc 10 years.

Manufacturing overhead costs MOH cost. The depreciation deduction provided by 167a for tangible property placed in service after 1986 generally is determined under 168 the Modified Accelerated Cost Recovery System. The annual amount is calculated as.

Control systems excluding personal computer s 10 years. A fixed asset is a long-term tangible piece of property that a firm owns and uses in its operations to generate income. The reduced tax payable table shows an estimated minimum and maximum tax refund based on.

Cereal and pasta product manufacturing. The cost of the machinery amounts to 350000 and the expected salvage value of the. 100000 and the useful life of the machinery are 10 years and the residual value of the machinery is Rs.

Match factories wooden match frames. Depreciation on Plant Machinery. According to GAAP generally accepted accounting principles manufacturing overhead should be included in the cost of finished goods in inventory and work in progress inventory on a.

Human pharmaceutical and medicinal product manufacturing. Water pollution control equipment Aerated detritus chambers. We have to find the straight line depreciation method using the first method.

The results for the propertys estimated depreciation for the first five years are separated into Plant Equipment removable assets and Division 43 capital works allowance. Depreciation of the manufacturing equipment. You are required to calculate manufacturing overhead based on the above information.

22000 15000 10000 47000 total manufacturing cost. Annual depreciation expense 60000 - 10000 50000. Find out the depreciation rates on assets as per Income Tax Act 1961.

Double Declining Balance Method. Rigid and semi-rigid. Depreciation on Office Building.

Control systems excluding personal computer s 10 years. Learn about the concept of block of assets and conditions for claiming depreciation. Insurance and property taxes on the manufacturing equipment and facilities.

Applying the formula So the manufacturing company will depreciate the machinery with the amount of 10000 annually for 5 years. Use the above-given data for the calculation of manufacturing overhead. It typically follows Long-term Investments and is oftentimes referred to as PPE Items appropriately included in this section are the physical assets deployed in the productive operation of the business like land buildings and equipment.

Equipment parts and supplies. A list of commonly used depreciation rates is given in a. Ammonia manufacturing assets.

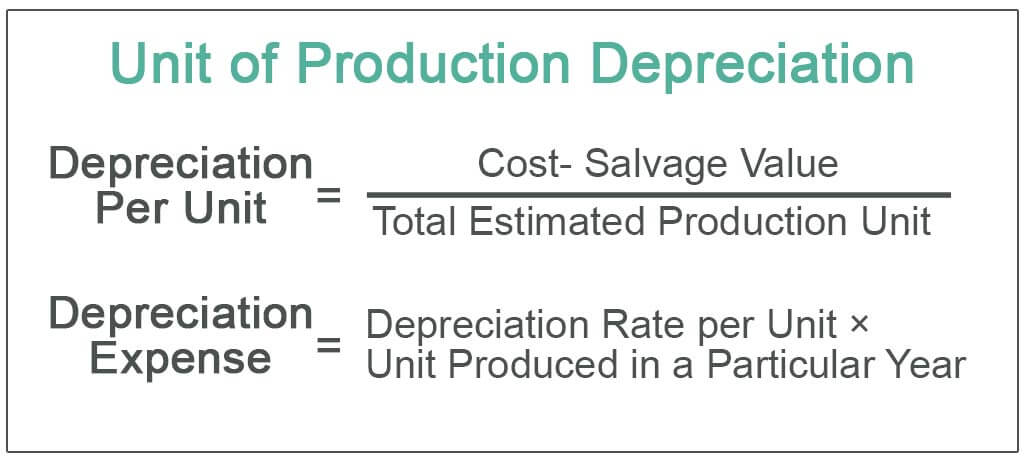

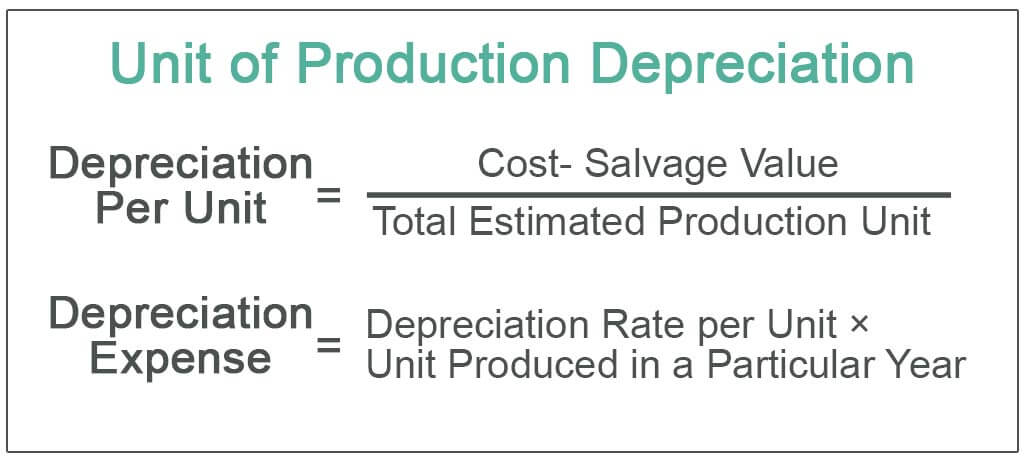

Depreciation Rate as Per Income Tax Act - The depreciation rate is the percentage of an asset that is depreciated over its estimated useful life. Safety and environmental costs. Finally the Depreciation expense is calculated by applying the estimated values in the below formula.

Property Plant Equipment is a separate category on a classified balance sheet. Thus the company can take Rs. In other words the final years depreciation must be the difference between the NBV at the start of the final period here 2401 and the salvage value here 0.

A large manufacturing corporation purchases new machinery for production. Since the costs and expenses relating to a companys administrative selling. Straight-line depreciation Original value Salvage ValueUseful Life.

In the previous example we determined the ACV of your 13-inch laptop was 600 and the cost of a similar laptop is 1000. Fixed assets are not expected to be consumed or converted into. If the expected salvage value of the equipment is 5500 at the end of its eight-year lifespan the annual accumulated depreciation is.

8000 as the depreciation expense every year over the next ten years as shown in the. It can also be defined as the percentage of a companys long-term investment in an asset that it recovers as a tax-deductible expense over its useful life. The company takes 50000 as the depreciation expense every year for the next 5 years.

Example Suppose a manufacturing company purchases machinery for Rs. Annual Depreciation expense 100000-20000 10 Rs. Depreciation on plant buildings and equipment janitorial and maintenance labor plant supervision materials handling power for plant utilities and plant property taxes.

Furnishing transportation communication electrical energy gas water or sewage disposal. Salaries of Production Staff. Depreciation under Companies Act 2013 SCHEDULE II See section 123 USEFUL LIVES TO COMPUTE DEPRECIATION.

Definition of Tax Depreciation. Example of straight-line depreciation without the salvage value. Property Taxes on Production Unit.

The tax depreciation is based on the regulations of the Internal Revenue Service. Such activities include manufacturing production or extraction. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

Definition Importance and Benefits. Total Depreciation Per Unit Depreciation Total number of Units Produced. Under GAAP its important that depreciation is charged in full so the total amount of depreciation for the computers needs to add up to 10000.

Assume a business buys a machine for INR 1crore with a useful life of 25 years and a salvage value of INR 10 lakhs. If you purchase a 15-inch laptop for 1500 and submit a request for recoverable depreciation you will be reimbursed 400.

Unit Of Production Depreciation Method Formula Examples

Accelerated Depreciation And Machinery Purchases Farmdoc Daily

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

No comments for "Depreciation of Manufacturing Equipment"

Post a Comment